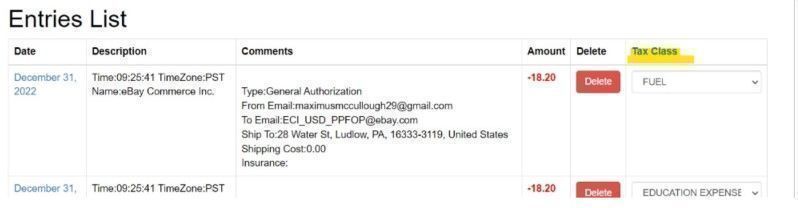

After successfully importing your bank records, you can proceed to the details page to further refine your financial information. On this page, you have the ability to assign tax classes to each transaction, specifically tailored to the tax cuts and benefits relevant to a Waste Management Company.

Here's how you can categorize transactions with the appropriate tax class:

1. Access the details page within the application, where you can view and manage your financial data.

2. Review each transaction and locate the last column, which is dedicated to selecting the tax class.

3. Choose the appropriate tax class for each transaction, ensuring alignment with the specific tax cuts and benefits applicable to Waste Management Companies.

By assigning tax classes to your transactions, you gain better control over your financial records and ensure accurate tax calculations. This feature helps streamline tax reporting and ensures compliance with relevant regulations.

Make the most of the details page by carefully selecting the appropriate tax classes for each transaction. This process provides clarity and transparency in your financial data, facilitating smooth tax management for your Waste Management Company.